According to Johns Hopkins, global deaths from COVID-19 have nearly hit 1.54 million. Worldwide cases have risen to 67.1 million. In the U.S., there are 14.7 million cases with over 282,000 deaths.

…And without some progress in Washington this week, things could get a lot more difficult, at least for those of us who have managed to avoid infection thus far. We’re entering the most horrifying phase of the pandemic, and I have concerns that we are going to get hammered if Congress doesn’t come to the rescue right away.

It’s no secret that much of the stock market’s performance in 2020 can be attributed to ultra-easy monetary policy by the Federal Reserve. Money supply is up an unprecedented 24% year over year, and along with fiscal measures, it’s resulting in stimulus that represents a whopping 50% of the U.S. economy.

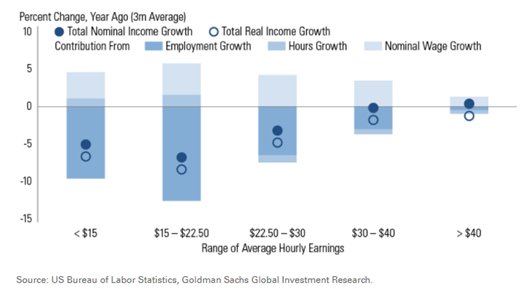

However, the economic recovery remains uneven across income brackets, with lower-income groups experiencing the greatest job losses given their concentrated employment in virus-sensitive sectors.

While roughly half of the remaining job losses since February may be temporary in nature, we still believe continued fiscal support remains an important economic bridge for households to stay afloat until a vaccine is broadly distributed.

There are plenty of bulls out there, and long-term, I’d say that’s still us. However, one should always question the legitimacy of short-term price action and maintain an independence in view, which is why I find it a bit humorous that the same people who were confidently bearish in March, 2020 (and critical of our optimism) are now bullish.

We recommend that investors take an active approach to their risk management. While we continue to believe that the U.S. economy is in the early stages of a multi-year bull market, we feel there’s a strong likelihood of increased volatility through the end of the year.

For disclosure information please visit: https://www.rgbarinvestmentgroup.com/terms-and-conditions

Comments